PACE financing allows property owners to use government taxing authority to the property owner’s advantage.

Energy efficiency is on the minds of many commercial real estate owners. Facility programs to improve energy efficiency provide a way to reduce operating costs, increase property values, and enhance occupant comfort. But two main obstacles can prevent owners from making energy improvements: lack of capital and the inability to find viable financing sources.

To overcome these barriers, commercial property owners in some states have been using Property Assessed Clean Energy (PACE) financing, which provides funding for energy efficiency, water conservation, and renewable energy projects. Recent and upcoming legislation will make this strategy increasingly viable for Illinois firms.

What is PACE financing?

PACE financing allows a property owner to use the local government’s taxing authority to the property owner’s advantage. The property owner voluntarily enters into a special assessment agreement, which is paid off as part of the company’s property tax bill (typically over the next 15 to 20 years).

PACE is fundamentally different than a traditional bank loan. It offers advantages that can transform an energy project from an engineer’s great idea (that the company CFO will not approve) into a clear bottom-line winner. Here’s how:

- Since the PACE loan is a special assessment obligation, it is very secure for the lender.

- Up to 100% of the project’s hard and soft costs can be covered under a PACE special assessment.

- Private capital providers fund PACE projects at competitive rates that are fixed for the entire term of the assessment.

- The PACE special assessment “runs with the land” – in a sale, the PACE assessment automatically transfers to the new owner, who then simply picks up the PACE payments (and energy savings).

- PACE special assessments feature terms of 10 to 25 years (up to the useful life of the improvements or equipment involved) – much longer than a traditional bank loan.

- Bottom line: Property owners doing PACE projects will generally pay nothing down and will typically generate more money in energy savings than the payments required to service the special assessment. The project will be cash flow positive from beginning to end.

How does PACE work?

Financing is arranged through a local program administrator who ensures that applications meet specific guidelines. Capital providers and project developers work with building owners and contractors to fund projects. The property owners repay the long-term improvement financing through an assessment included on the real estate tax bill.

The PACE financing lien is affixed to the property – not to an individual or business – until the financing is repaid. Since PACE is repaid through the property tax bill, it is non-recourse to the individual property owner. If the commercial real estate property is sold before the PACE assessment is fully paid, the lien stays with the property and remains the responsibility of the new owner as part of the real estate taxes as the savings from the energy efficiency project continue to benefit the new owner.

Where Is PACE Financing Available?

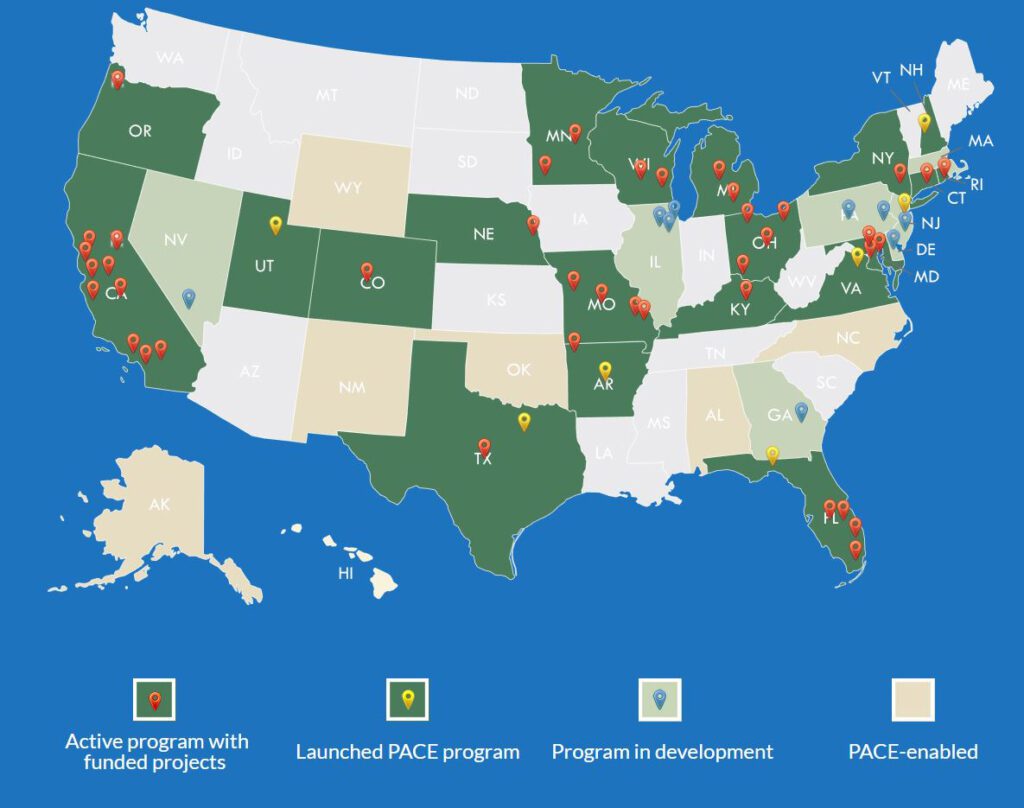

PACE-enabling legislation is active in 36 states plus the District of Columbia. PACE programs are now active (launched and operating) in 20 states plus DC. This roster now includes Illinois, where a number of jurisdictions are finishing formulating their programs. Programs in Kane and DuPage counties are expected to begin operation in early 2019. Programs for suburban Cook County and the City of Chicago are in development and may be expected to follow shortly thereafter.

More info on availability of PACE financing across the entire USA is shown on the map below, from PACENation, an advocacy group:

What qualifies

- A wide variety of building improvements and measures that have an energy efficiency, water efficiency, or renewable energy project component.

- Project size: Although small projects technically qualify, it makes the most sense to finance projects in excess of $200,000, with no formal upward limit.

- Current on property taxes: Properties must be current on their property taxes and any other property tax obligations to qualify for PACE financing.

Not sure if your property or project qualifies? Contact Grumman/Butkus Associates.

The value of PACE

From a property owner’s perspective, PACE financing has many benefits. PACE offers up to 100% financing; therefore, the owner does not have to worry about up-front capital and can reallocate funds that were previously reserved for energy projects. The energy savings from PACE-financed projects can also increase a property’s value and cash flow. In addition, the availability of PACE financing provides access to energy efficient technology that the owner might not otherwise be able to afford.

Municipalities can also see benefits from PACE in terms of economic development, job creation, increased property values, and the fact that there are no or low costs to the issuer or government body.

Commercial PACE is now available in Illinois. Legislation for PACE financing in Illinois started in 2009 with the passage of a basic PACE bill. In 2017, SB1700 – HB2831 successfully passed committees, and in August, the governor signed it into law. Illinois’ PACE law is only in effect for commercial properties.

The introduction of PACE in Illinois will help spur more energy efficient projects within the commercial real estate market, improve property values, and create jobs in the clean and renewable energy industries.

Benefits of PACE financing

- 100% up-front financing

- Long-term financing from 10 to 25 years

- Fixed interest rate

- Positive cash flow!

- The loan runs with the land, meaning the loan is attached to your property, not to you as the property owner. It does not impact your credit, and it transfers upon sale.

How to get started

Your first step toward completing a PACE project should be to contact us. We can help you determine if your property and project are eligible for PACE financing. Then, we can put you in touch with the right people to get the job done.